"In playing ball, and in life, a person occasionally gets the opportunity to do something great. When that time comes, only two things matter: being prepared to seize the moment and having the courage to take your best swing." -Hank Aaron

Shoutout: Sats Misfit, looking forward to hanging with you next week. Keep going with full strength and no weakness.

Music Artist: L’Impératrice

Song Title: Hématome

Weather

Weather man woke up? Perhaps..perhaps. Thunder and lighting in parts of Texas this week and the northeast is in the 50’s for the lows. At least a sigh of ‘relief’ from the recent heat that some of the parts of the country experienced this summer. Although this is NOT the hottest summer on record, it did manage to creep into the top 10 hottest summer on record as #10 hottest summer since the 1950’s. The summer of 2022 still holds the record as the hottest summer on record and in 2nd place is summer of 2011. Those are measured in the total amount of cooling degree days for the summer from June 1-August 31. The total amount of CDD’s for this summer was ~978, for the 2011 summer was ~1048 and the hottest summer in the #1 spot (2022) was a total of 1055 CDD. Precipitation seems to be above normal as we stride right into the cooler months of the year in most parts of the world. NOAA’s temperature outlook is decently colorful with below average temperatures in the western part of the US, relatively normal temperatures in the east coast and above average temps in the midwestern/central part of the US. Pretty red colors display in the 8-14 day outlook on the east coast side. Lee and Margot are hanging out in the Atlantic as far as hurricanes go. Margot doesn’t seem to be much of a threat to the US and even Lee is moving more north according to NOAA’s outlook on Lee’s path currently. Can fall season be upon us? Maybe for some. Folks are asking me about winter and honestly, theres only one that truly knows and therefore I surrender. Them meteorologist are saying that it will be warmer than normal, I tend to agree.

Market Intel

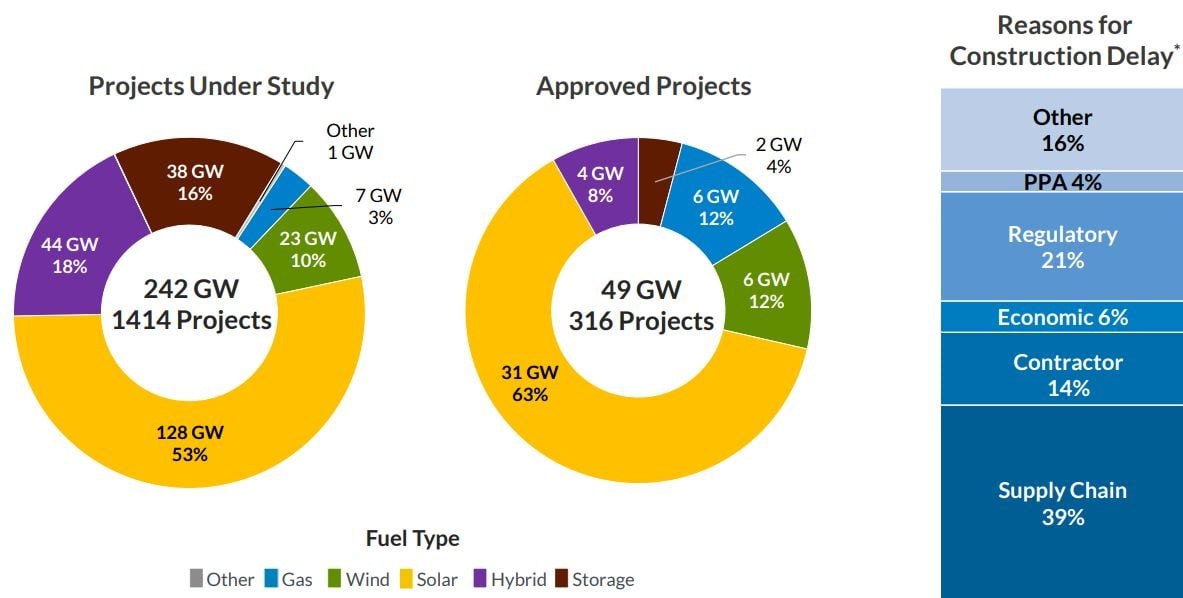

I find it interesting that Apple is marketing a new tool in the ‘home app’ called ‘Grid Forecast’. Basically the app will show the user when the users gird is ‘clean’ and when there is ‘less clean’ resources available. I guess this could be similar to an ISO’s mobile app when they give voluntary conservation notices asking for folks to turn the AC up, turn the TV’s off and refrain from taking a hot shower and whatnot. Apple stated, “As Apple decarbonizes its value chain, the company is also committed to engaging with customers and creating technology that helps them understand and address their environmental impact." Well ok then. In other news the biggest renewable energy conference was this week and it was so large that you hop off the airport in Vegas and you can receive your registration badge right in the airport. With the amount of renewables coming on the grid, what’s in the interconnection que, and the amount of $$ flowing from the inflation reduction act its no wonder this conference was pact with humans. I assume a hot topic is, “how do we get all the IRA money?” and also “what happens if China wont supply us with panels?” These would be questions I would have anyway. Finally, there is somewhat of a breakout in WTI crude pricing due to Saudi and Russian oil production cuts up to ~1.3 mm barrels per day. There is a decent amount of what’s called associated natural gas that comes from the drilling and production of oil. Drill for oil, you find natural gas is what that means. If WTI crude continues to tear, will we begin to see more associated natural gas into the market? Into storage? I believe folks can make a spread on a $100+ barrel of oil. Maybe the aliens we saw this week in Mexico can weigh in? They’re as real as people saying they saw UFO’s in the sky when it was just the new Starlink satellites that were recently deployed, in my opinion of course. Finally it seems that MISO had about 49 GW of planned capacity (mostly solar) clear the interconnection process however there is now an average of 2 year delays in having those panels to be energized. Load growth in MISO is simultenously occurring and their executive director for transmission planning is quoted saying, “Listening to our members, we are hearing that there is a continued high likelihood that we will see these larger industrial loads, commercial loads or things like data centers, hydrogen facilities, drive large load additions.” That load growth is expected to be ~21 GW. It’s quite interesting to me with folks and their difference between goals and reality when it comes to electricity development + growth. Nothing is never close to accurate however just sit back and watch.

Electricity

The downhill fall in electricity pricing from 2022 is steep, in a good way. I keep mentioning that and it just was a wild and crazy year for all energy markets in 2022. In electricity, and as well with other energy commodities, it’s all about energy per unit time. It’s a kilo watt per hour of time (sure you can break that down even further if you so desire). Then an annual consumption of those same kilowatts coorelated in 8760 hours of the year. Remember there are 3412 Btu’s per 1 kWh and there are 8760 hours in one year. So when looking at a forward price for a 12 mth (8760 mega watt hours or 8,760,000 kilowatt hours) Im seeing some of the pricing hubs get back to somewhat of a normal. Keyword is somewhat, simply because the stagnant pricing we had for about 10+ years is just not the same marketplace as what we have now. If you look at the generation fleet mix that was in ERCOT (as an example) in 2013, Wind was ~10% of the generation fleet mix in 2013, now YTD it is ~27%. Coal electric generation in 2013 in ERCOT was ~37%, now YTD Coal electric generation is ~13%. In 2013 in ERCOT solar was ~.05% of the fleet and now in 2023 it is ~7% on average. Pretty interesting eh? When looking at a historical index of pricing versus what the forward curve looks like, everything is ‘inflated’ and those deltas between the to range all over the place. Pricing for forward hedges will continue to print for a premium until more fuel costs come down enough to yield the correlation. Gas is still very much needed for power burn and if we didn’t have this, we would be in big trouble. If you're asking yourself, if natural gas is so cheap currently then why is electricity pricing so high? I mentioned this enough times for you to understand what’s going on here in my view.

Natural Gas

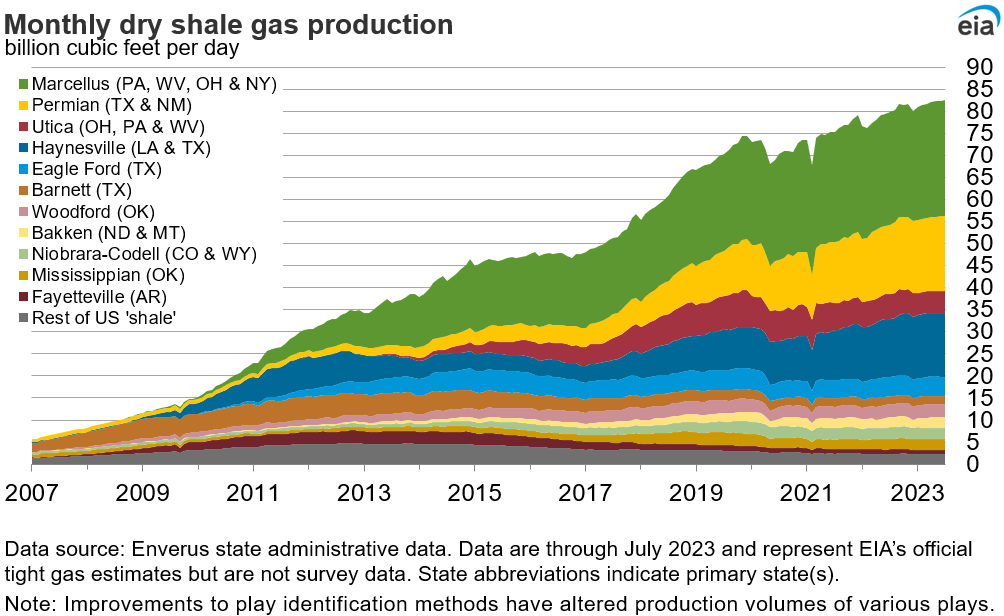

Natural Gas ripping! Sike, not really at all. Prompt month (now October) is still well under $3/mmbtu, see the statistics chart for the real time approximate NYMEX price. Regarding the production of natural gas, this whole year has been steadily above 100 BCF/day with only a small variance in either direction that is marginal. YoY production is up over last year at ~4.5%. As mentioned previously the rig counts are something that is really concerning. Currently natural gas rigs are down ~32% from last years rig counts and oil rigs are down ~13% from last years counts. With the decline in rig counts, the demand for natural gas to burn for power and the growth of LNG demand globally the US could be prime for an increase in price as common sense may tell you. But we were also saying that when Freeport came back on after for being down a few months and the market was still sleeping. Aliso Canyon in California just got approved by the California Public Utility Commission for an increase for regional natural gas storage from ~40 BCF to ~68 BCF. This will certainly help the west out with the demand for natural gas and possibly help with the dependency on importing electricity into the California ISO, keyword possibly. Natural Gas storage came in at 57 BCF injection which brings storage up 16.1% over last year and 6.8% over the 5 year average. Market seems to be ok with this as there isn’t much movement on the NYMEX. Interesting to see that the south central region in storage had its first injection since mid June due to the overall demand for NG for power burn, weather is getting better there but still hot. October contract on the NYMEX futures closes on 9/27/2023 just keep in mind. One final note, exports into Canada and to Mexico are ripping honestly with Mexicos exports through pipeline reaching a monthly high of 6.8BCF/day in June 2023. Growth in the power demand for NG burn is significant in Mexico since 2018, thus more imports of NG.

LNG

According to the EIA the US is the top country to export the most LNG in the first half of 2023. In second place for LNG exporters was Australia and in third place was Qatar. It’s interesting that the EIA is stating that the reason for the large increase in exports is from Freeport LNG return to service the growing demand globally. Then just as of Sept 10th, the operator of the Gulf South Pipeline notified Freeport stating that it is anticipating reductions of delivery to Freeport until further notice due to Freeports failure to take in confirmed quantities. Tilt head to the side here. Check out the article I have in here from S&P on the Freeport issue. Always an issue huh? Maybe. Looks like the Dapping Princess, the worlds largest shallow draft LNG carrier has ensured some operational reliability and maintenance flexibility with striking a deal between Wärtsilä and China LNG Shipping (International) Company Ltd. Remember in the US we have the Jones Act which I have mentioned before. Simply put we need other foreign vessels to be in the mix in order for gas to flow around the globe and go after those margins. According to the EIA, 18 vessels with a combined 67 BCF departed the US between 9/7-9/13.

Charts/References

NYMEX Historical Pricing 2000-present

Conclusion

Just hang in there they say. Well, ok then. I will and I wont stop. Can’t stop, wont stop. It’s hard but if it aint hard then what’s the fun? Check out the this weeks track. Turn the bass up this weekend. Have a great day, peace and love. Bass

*ALL views and opinions are my own. All data comprised can simply be looked up by a simple search engine.

![[Key Messages] [Key Messages]](https://substackcdn.com/image/fetch/$s_!yaXt!,w_1456,c_limit,f_auto,q_auto:good,fl_progressive:steep/https%3A%2F%2Fsubstack-post-media.s3.amazonaws.com%2Fpublic%2Fimages%2Ff1f52962-3d7a-4ddb-897a-94708f7523ef_897x681.png)